Cannabis Corner

Enhancing Your Compliance Program to Accommodate Cannabis Banking

Your financial institution is seeking new revenue streams and you’ve heard that Cannabis Banking can be a significant source. You already have some clients that may be Cannabis Related Businesses (CRBs) and you want to make sure your Compliance Program, including BSA, is up to date with all of the current regulatory mandates. Your state has legalized Cannabis (medical or recreational) and you want to make sure that these clients do not exist at your financial institution. No matter where your financial institution stands on the subject of Cannabis Banking, your Compliance Program needs to be enhanced to address it.

RLR Management Consulting, Inc. has been writing, enhancing, and auditing Compliance Programs for financial institutions for over 30 years and we have been closely monitoring the Cannabis Banking environment and associated regulatory guidance. Last year, we updated our BSA Audit Program to include guidance on Cannabis Related Businesses. Further, through our ongoing research and analysis of Cannabis Banking we have concluded that a technology component that identifies tracks, monitors and manages cannabis related transactions is paramount to an FI’s success as they move forward with this new business venture. We have performed research on several Cannabis Technology vendors.

Are you scared? Intrigued? Something in between?

No matter what position your financial institution takes on the subject of Cannabis Banking, RLR Management Consulting, Inc. can assist you. We can enhance your current BSA Program with Cannabis Banking elements to ensure regulatory compliance; review or audit your existing program and make recommendations for improvement or assist you in creating a Cannabis Banking Compliance Program adding a new source of revenue for your financial institution. Contact us at info@rlrmgmt.com and let’s discuss the options.

Have a question about Cannabis? Ask our experts.

Cannabis Podcast

| Title | Description | Link |

| How do you assess the legal and regulatory risks associated with providing services to cannabis businesses | EP1: YouTube | |

| What are the potential growth opportunities and revenue streams for your bank in the cannabis banking sector, and how can you capitalize on them effectively? | EP2: YouTube | |

| What are some common challenges financial institutions face when providing services to cannabis businesses, and how can they overcome these challenges? | EP3: YouTube |

Services

- What does a CRB Program Risk Assessment look like?

- Financial Institution’s Qualifications

- Board of Directors Acceptance

- Current BSA/AML Program

- Financial Strength of the institution

- Staffing and Expertise

- Technology

- Legal

- Legal Consultation

- Review of Federal and State guidance and City/County Ordinances

- CRB Types and Enhanced Due Diligence

- Tier Structure

- CRB Owners and Employees

- Hemp

- Training

- Board of Directors

- BSA/AML Staff & Compliance Officers

- Customer Facing Staff

- BSA/AML Audit

- Expertise, Scope, and Frequency

- Competition and Potential

- Other FIs Banking CRBs in Your Market Area

- Reputation Potential

- Market Potential

- Revenue Potential

- Liquidity Potential

- Products and Services

- Deposit Accounts

- Lending

- Online Banking

- Cash Management

- Debit/Credit Cards

- Other Products and Services

- Operations

- Red Flags

- Cole Memo Priorities

- California DBO Guidance

- CSBS Job Aid

The CRB Program Risk Assessment will include a review of and guidance on:

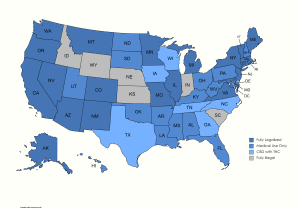

- State by State Cannabis Policy

| State | Medical Use | Recreational Use | State Marijuana Authority | Hemp | State Hemp Authority | Additional Notes |

|

California |

Yes |

Yes |

|

Yes |

State hemp plan approved under the final rule in 2021.

The attorney general released new medicinal cannabis guidelines August 6, 2019. link |

|

|

Colorado |

Yes |

Yes |

Yes |

State plan approved by USDA under the final rule in 2021.

Online portal for hemp growers to submit applications and payment. |

||

|

Connecticut |

Yes |

Yes |

|

Yes |

A recreational marijuana law (S.B. No. 1201 passed and was signed into law June 22, 2021.

State hemp plan approved by USDA under the final rule in 2021. |

|

|

Delaware |

Yes |

Yes |

Medical Marijuana Program – Delaware Health and Social Services – State of Delaware |

Yes |

Hemp Program – Delaware Department of Agriculture – State of Delaware | Adult use marijuana approved April 22, 2023.

State hemp plan approved by the USDA as of January 28, 2020. |

| Idaho | No | No | N/A | Yes | Hemp – Idaho State Department of Agriculture | State hemp plan approved under the final rule in 2021. |

|

Illinois |

Yes |

Yes |

|

Yes |

|

State hemp plan approved by the USDA under the final rule.

Illinois was the first state to fully legalize through the legislative process – effective January 1, 2020. Cannabis frequently asked questions link |

|

Indiana |

No |

No |

N/A |

Yes |

Indiana Hemp Regulatory Website (purdue.edu) | State hemp plan approved by the USDA as of October 19, 2020.

Medical use of CBD oil is allowed. |

|

Indiana |

No |

No |

N/A |

Yes |

Indiana Hemp Regulatory Website (purdue.edu) | State hemp plan approved by the USDA as of October 19, 2020.

Medical use of CBD oil is allowed. |

|

Iowa |

Yes |

No |

Yes |

Hemp Program | Iowa Department of Agriculture and Land Stewardship (iowaagriculture.gov) |

State hemp plan approved by the USDA as of March 19, 2020. |

|

| Kansas | No | No | N/A | Yes | Industrial Hemp (ks.gov) | State hemp plan approved under the final rule in 2021. |

|

Kentucky |

Yes |

No |

Yes |

Industrial Hemp Research Pilot Program (kyagr.com) | State hemp plan approved by USDA under the final rule in 2021.

Medical approved March 31, 2023. |

|

|

Louisiana |

Yes |

No |

Medical Marijuana | La Dept. of Health |

Yes |

Industrial Hemp – Department of Agriculture and Forestry (state.la.us) | State hemp plan approved by USDA under the final rule. |

| Maine | Yes | Yes | Office of Cannabis Policy (maine.gov) | Yes | Hemp: Animal and Plant Health: Maine DACF | State plan approved by USDA under the final rule in 2021. |

|

Maryland |

Yes |

Yes |

Yes |

|

State hemp plan approved by USDA as of August 11, 2020.

Recreational use approved by voters November 2022 effective July 1, 2023. |

|

|

Massachusetts |

Yes |

Yes |

Cannabis Control Commission Massachusetts (masscannabiscontrol.com) |

Yes |

Industrial Hemp Program | Mass.gov | State plan approved by USDA under the final rule in 2021. |

| Michigan | Yes | Yes | MRA – Marijuana Regulatory Agency (michigan.gov) | Yes | MRA – Marijuana Regulatory Agency (michigan.gov) | State hemp plan approved by USDA under the final rule in 2021. |

|

Minnesota |

Yes |

Yes |

Yes |

Hemp Program | Minnesota Department of Agriculture (state.mn.us) | State hemp plan approved under the final rule in 2021.

Recreational marijuana bill signed by the governor May 30, 2023. |

|

|

Mississippi |

Yes |

No |

N/A |

Yes |

Hemp Cultivation in Mississippi – Mississippi Department of Agriculture and Commerce (ms.gov) | State will operate under USDA hemp rules.

Medical marijuana law signed by governor on February 2, 2022. |

|

Missouri |

Yes |

Yes |

Medical Marijuana Regulation | Health Services Regulation | Health & Senior Services (mo.gov) |

Yes |

|

State will operate under USDA hemp rules.

Updated application process Recreational use approved by voters November 2022. |

|

Montana |

Yes |

Yes |

Cannabis Control Division – Montana Department of Revenue (mtrevenue.gov) |

Yes |

State hemp plan approved under the final rule in 2021.

Marijuana legalization passed on November 3, 2020. |

|

|

New Mexico |

Yes |

Yes |

Yes |

Hemp Program – New Mexico Department of Agriculture (nmsu.edu) |

State hemp plan approved under the final rule in 2021.

Marijuana legalized for adults April 12, 2021 – retails sales are to begin by April 1, 2022. Updated hemp frequently asked questions link |

|

|

New York |

Yes |

Yes |

|

Yes |

Industrial Hemp Research Initiative | Empire State Development (ny.gov) |

State hemp plan approved by the USDA under the final rule in 2021.

Recreational marijuana legalized March 31, 2021. Hemp legislation was signed into law on December 9, 2019 S 6184-A |

|

North Carolina |

No |

No |

N/A |

Yes |

North Carolina Department of Agriculture & Consumer Services (ncagr.gov) | State will operate under USDA hemp rules. |

|

North Dakota |

Yes |

No |

Division of Medical Marijuana | Department of Health (nd.gov) |

Yes |

Hemp | North Dakota Department of Agriculture (nd.gov) | State hemp plan approved under the final rule in 2021.

Recreational use rejected by voters November 2022 and 2018. |

|

Ohio |

Yes |

No |

Yes |

Welcome to the Hemp Program | State hemp plan approved by USDA December 27, 2019.

Senate Bill 57 legalized hemp and hemp-derived CBD on July 30, 2019. |

|

|

Oklahoma |

Yes |

No |

Yes |

Plant Industry – ODAFF (ok.gov) Scroll down to Industrial Hemp |

State hemp plan approved by USDA as of October 19, 2020.

Recreational use initiative on the ballot March 7, 2023. |

|

| Oregon | Yes | Yes | Marijuana and Hemp (Cannabis): State of Oregon | Yes | State of Oregon: Hemp | State hemp plan approved by the USDA under the final rule in 2021. |

| Pennsylvania | Yes | No | Medical Marijuana Program (pa.gov) | Yes | Industrial Hemp (pa.gov) | State hemp plan approved by the USDA under the final rule in 2021. |

|

Rhode Island |

Yes |

Yes |

Medical Marijuana Information for Patients and Caregivers: Department of Health |

Yes |

Rhode Island Department of Business Regulation: (ri.gov) Scroll down to Industrial Hemp |

State hemp plan approved by the USDA as of January 11, 2021.

Recreational marijuana legalized May 25, 2022 Governor McKee Signs Legislation. Public sales begin December 1, 2022. |

|

South Carolina |

No |

No |

N/A |

Yes |

Hemp Farming Program – South Carolina Department of Agriculture (sc.gov) | State hemp plan approved by USDA under the final rule in 2021. |

|

South Dakota |

Yes* |

No* |

|

Yes |

|

State hemp plan approved by USDA under the final rule in 2021.

House Bill 1203 was signed into law March 25, 2021 authorizing banks to engage in business with hemp and marijuana licensees *Recreational and medical ballot initiatives passed on November 3, 2020. Recreational use was overturned by the SD Supreme Court on November 24, 2021. Recreational use rejected by voters November 2022. |

| Tennessee | No | No | N/A | Yes | Hemp Industry (tn.gov) | State hemp plan approved under the final rule in 2021. |

|

Texas |

Yes |

No |

Compassionate Use Program (texas.gov) |

Yes |

Texas Industrial Hemp Program (texasagriculture.gov) | State hemp plan approved by the USDA as of January 28, 2020.

Medical use of CBD oil is allowed. |

|

Utah |

Yes |

No |

Yes |

Industrial Hemp Program | Utah Department of Agriculture and Food | State will operate under USDA hemp rules | |

|

Vermont |

Yes |

Yes |

Yes |

Hemp Program | Agency of Agriculture, Food and Markets (vermont.gov) | State will operate under USDA hemp rules.

Recreational sales started October 1, 2022. |

|

|

Virginia |

Yes |

Yes |

|

Yes |

|

State hemp plan approved by USDA under the final rule in 2021.

Recreational marijuana was legalized beginning on July 1, 2021. Historical Note – In 1619, the Virginia colony passed a law requiring farmers to grow hemp. |

|

Washington |

Yes |

Yes |

Yes |

State hemp plan approved by USDA under the final rule in 2021.

Information on hemp for marijuana licensees link |

||

|

West Virginia |

Yes |

No |

Office of Medical Cannabis (wv.gov) |

Yes |

Industrial Hemp Licenses: West Virginia Department of Agriculture (wv.gov) | State hemp plan approved by USDA under the final rule in 2021 |

|

Wisconsin |

No |

No |

N/A |

Yes |

DATCP Home Hemp Research Program (wi.gov) | State will operate under USDA hemp rules.

Medical use of CBD oil is allowed. |

|

Wyoming |

No |

No |

N/A |

Yes |

State hemp plan approved by the USDA as of February 26, 2020.

The governor issued an update on hemp August 6. link |

- Territory Cannabis Policy

|

Territory |

Medical Use | Recreational Use |

Territory Marijuana Authority |

Hemp |

Territory Hemp Authority |

Additional Notes |

|

Guam |

Yes |

Yes |

Cannabis Control Board | Guam Dept. of Revenue and Taxation (guamtax.com) |

Plan for cultivation and sale are expected in April 2020 – link to news report. The Cannabis Control Board issued a fact sheet on cannabis.

Guam has not submitted a hemp plan to the USDA. |

||

|

Northern Marianas |

Yes |

Yes |

Cannabis | CNMI Office of the Governor |

Yes |

Hemp rules pending legislation

Recreational use law amended August 2019 Public Law 21-05 |

|

| Puerto Rico | Yes | No | Yes | HEMP Licensing and Inspection Office | PRDA (agricultura.pr) | Hemp plan approved by USDA as of July 15, 2020. | |

|

Virgin Islands |

Yes |

No |

Yes |

VIDA | Department of Agriculture

Scroll down to Hemp Program |

Hemp plan approved by USDA as of May 29, 2020.

Bill No. 34-0345 legalizing adult use awaiting governor’s signature. |