Why these three de novos went nowhere

June 01 2018, 2:18pm EDT

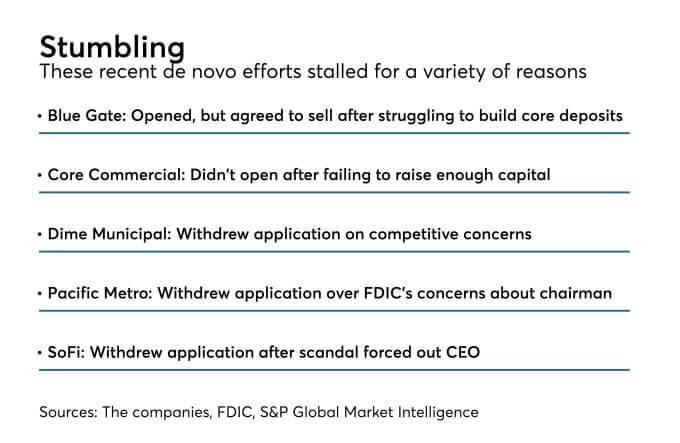

Recent de novo activity hasn’t been all blue skies and sunshine.

Many bankers have been eager to see more banks open since the financial crisis. Lately there has been a slight increase in the number of groups applying for charters, and some have already been successful.

Still, several efforts have faced hurdles at different stages of the de novo process.

Organizers of Pacific Metro Bank in Johns Creek, Ga., withdrew an application last year, and Core Commercial Bank in Newport Beach, Calif., never opened even though it secured regulatory approval.

Blue Gate Bank in Costa Mesa, Calif., which opened in January 2017, has already agreed to be sold.

These developments provide important lessons by shining a light on the issues regulators are following, experts said.

These developments provide important lessons by shining a light on the issues regulators are following, experts said.

Regulators “don’t want to see another bank fail,” said Mitch Razook, president and chief operating officer at RLR Management Consulting. “If they approve a bank opening, they will be prudent about the management team, the business plan, the board of directors, the capital requirements. All of that.”

After raising $30 million, Blue Gate opened to much fanfare as one of the first post-crisis de novos. The fact that it was able to open was a testament to the strength of its business plan, ability to raise capital and management team, industry experts said.

Sixteen months later, the $130 million-asset bank is being sold to Big Poppy Holdings, the Santa Rosa, Calif., parent of Poppy Bank. The institutions are both majority owned by the Gallaher family, and Blue Gate is being sold because of the regulatory environment, said Khalid Acheckzai, Big Poppy’s CEO.

Specifically, Blue Gate has been unable to comply with the business plan it gave regulators when it was chartered, according to the public portion of the Poppy’s merger application. Though it started a successful Small Business Administration lending effort, Blue Gate has struggled with bringing in enough core deposits to keep pace with loan growth, the application said.

Blue Gate wanted to pursue deposit funding strategies that Poppy has used “for over a decade,” but the Federal Deposit Insurance Corp. and the California Department of Business Oversight would not sign off on the plan, Poppy said in its application. The filing did not specify the strategies Blue Gate wanted to try.

The bank likely wanted to use noncore funding, such as brokered deposits, to support loan growth, industry experts said.

Blue Gate did not return calls seeking comment. An FDIC spokeswoman said the agency does not comment on open institutions. A spokesman for the California Department of Business Oversight was not immediately able to comment.

Regulators have long had a negative view of brokered deposits, based on a belief that they can’t be relied on as a stable funding source. Brokered deposits were also associated with many aggressive growth strategies before the financial crisis.

Well-established and healthy banks can use brokered deposits and other funding sources, but it’s less likely regulators would back such a plan for a newly minted institution. That seems to be confirmed by Blue Gate’s decision to sell.

Core deposit funding “is an important measure of franchise value and will help the bank’s valuation, as well as its regulatory compliance,” said Chip MacDonald, a lawyer at Jones Day. “Many bank failures in the credit crisis have been attributed to a toxic combination of brokered deposits and high-risk lending practices funded from noncore sources.”

Blue Gate’s experience also serves as a reminder that executives should to stick to the plans outlined in their applications because it can be difficult to get regulators to back a significant change, industry experts said. Banks that veer too far from the plan without regulatory approval could face consequences that include enforcement orders.

“Regulators expect banks to have a vision and the expectation is that the business plan is going to be the plan that drives the bank,” said Ruth Razook, CEO at RLR Management, which has done some consulting work for Blue Gate. “They will listen to proposed revisions, but the overall expectation is that business plan you submit that gets approval will carry you for three to five years.”

Other snags have happened to groups trying to form de novos, hinting at other problems investors might face.

Core Commercial didn’t open after receiving regulatory approval because it was unable to raise the required capital, said several sources familiar with the situation. It is clear regulators are requiring far more capital, upward of $25 million, than they did before the crisis.

Management and board appointments also matter.

Pacific Metro, which had plans to banking Asian-Americans in Georgia, withdrew its application after regulators reportedly pressed expressed concerns over the bank’s proposed chairman. Gerald Lewis, who was set to become the bank’s CEO, eventually became the CEO of Bank of Wrightsville in Georgia.

Regulators are committed to making sure leaders have clean records and the right amount of experience, industry experts said.

Tom Rudkin, a principal at DD&F Consulting in charge of mergers and acquisitions and strategic business development, said he warns clients interested in opening a de novo that their background will be scrutinized.

“If there’s anything that calls into question your suitability, then don’t move ahead with the application,” Rudkin said.

Despite these hiccups, more groups are expected to try to form de novos.

Blue Gate’s decision to sell can be seen as unique, since it is merging with another bank with common ownership.

Other new banks are surpassing expectations, said Lee Bradley, a senior managing director at Community Capital Advisors, which has worked with organizers of recent de novos.

“We’re going to see more de novos, especially in markets where M&A has taken out a lot of banks and there aren’t many left,” Bradley said. “You’ll see de novos popping back up.”

Investors that are becoming involved in de novos now are true believers in the community banking model and want to open banks because they don’t feel like they are getting the service they want, Rudkin said. That’s a change from pre-crisis efforts, where many organizers were keen on building a bank to sell.

“Investors that have knowledge of how banks operate and the benefits of community banking are frustrated to the point where they say, ‘We will start our own bank,’ ” Rudkin said.

Paul Davis contributed to this story.