Flagstar Has Survived – Now It Must Reinvent Itself

See original article HERE

Flagstar Bancorp in Troy, Mich., is continuing to find ways to put its tumultuous past behind it.

Leading up to the financial crisis, the $16.8 billion-asset company relied heavily on national mortgage banking. That strategy proved to be disastrous when the mortgage-backed securities market collapsed.

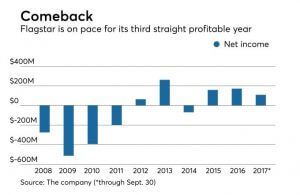

Flagstar remained deeply troubled, losing more than $1.4 billion from 2007 to 2011. Over that time, the company was weighed down by nonperforming assets, hit with a regulatory consent order tied to compliance and risk management and underwent management changes.

Recent years have been profitable, affording Flagstar more room to reinvent itself by making more commercial-and-industrial loans and diversifying its real estate book. Now the company is buying eight California branches – its third acquisition this year – from East West Bancorp to gain cheap deposits to support its loan growth.

Recent years have been profitable, affording Flagstar more room to reinvent itself by making more commercial-and-industrial loans and diversifying its real estate book. Now the company is buying eight California branches – its third acquisition this year – from East West Bancorp to gain cheap deposits to support its loan growth.

Despite the improvements, Flagstar’s future is far from certain. Investors remain skeptical of a business model that remains heavily reliant on mortgages. Its largest shareholder is a private equity firm that could view the company’s sale as a chance to exit the investment.

For now, management is focused on improving performance.

“The past is way in our rearview mirror,” said Alessandro DiNello, Flagstar’s president and CEO.

“We have to convince investors that we can run a company with the level of exposure to the mortgage business that we have and not have the volatility that most mortgage organizations have,” DiNello added. “Our plan is to keep doing what we’re doing and show we know how to manage this within the bank structure.”

Flagstar’s latest deal – the purchase of Desert Community Bank, a division of East West – includes $70 million in loans and $600 million in deposits in Southern California. The deposits should provide liquidity to a balance sheet with double-digit loan growth. Desert Community will retain its brand under Flagstar.

Flagstar “is working toward building its commercial banking business,” said Scott Beury, an analyst at Boenning & Scattergood. Desert Community “is an attractive deposit transaction that adds strong core funding. It will give them more of a presence in an economically sound market and they can build their brand and expand their deposit franchise there.”

Consolidation in California could open up more opportunities for Flagstar, said Mitch Razook, president and chief operating officer of RLR Management Consulting. The number of banks based in the state is down 38% from the end of 2010, according to data from the Federal Deposit Insurance Corp.

“There could be an opportunity for a relatively local bank if they wanted to grow that area,” Razook said. “But the downside of that is, if Desert Community is owned by Flagstar will people still consider that local?”

While expanding in California had been on DiNello’s radar, the company wasn’t limiting itself to that state, he said. All of the company’s branches are in Michigan, though some businesses, such as warehouse lending, on a national scale.

Flagstar purchased the mortgage lender Opes Advisors in Cupertino, Calif., and Residential Mortgage Delegated Correspondent Lending from Stearns Lending in Santa Ana, Calif., earlier this year. Other than Michigan, California generates the most revenue for Flagstar, DiNello said.

The company will take an opportunistic view of M&A, though DiNello said it doesn’t need a merger to make more money.

“My preference is to continue to grow as much as we can organically, but if the right opportunity presents itself we will look at it,” DiNello said.

In M&A, Flagstar may be constrained by its stock price. Its stock, while up roughly 35% this year, still trades below regional bank peers. Beury said Flagstar is trading at about 13 times Boenning’s 2018 earnings estimates, while other banks with $15 billion to $30 billion in assets are trading at 15 times next year’s forecasts.

That gap could close if Flagstar provides consistent results. Mortgage dealings, however, usually lead to volatile results, industry experts said.

“I think they have an interesting balance,” said Bose George, an analyst at Keefe, Bruyette & Woods. “They’re a very good mortgage company and the acquisitions they have done are good from an earnings standpoint. But bank investors don’t like significant mortgage earnings. It is a trade-off.”

There is also a question of how the private equity firm MatlinPatterson, which owns more than 60% of Flagstar, will handle its investment. An increase to the $50 billion asset threshold for systemically important financial institutions could makes Flagstar a more attractive target, said Jesus Bueno, an analyst at Compass Point Research & Trading.

One buyer could be Fifth Third Bancorp in Cincinnati, though it is currently dealing with a compliance issue tied to the Community Reinvestment Act. While Flagstar’s focus on mortgages may scare off other potential buyers, Fifth Third may find it to be a good fit. For instance, Flagstar recently launched a no-down-payment mortgage product that is similar to something that Fifth Third has.

A Fifth Third spokeman declined to comment. A call to MatlinPatterson was not returned.

“I think the endgame is a sale,” Bueno said. “I would not be shocked if in the next two or three years they sell the bank. Growing the commercial bank is geared toward improving the valuation and preparing it for an eventual sale.”

While MatlinPatterson may look for an exit in the next one to three years, DiNello said he didn’t believe a sale was inevitable. The investor could also cash out through a secondary offering.

“Our job is to get the stock trading where it should be, then that provides options to MatlinPatterson,” DiNello said. “We’re trying to develop a strong, independent bank.”

Jackie Stewart covers community banks and mergers and acquisitions for American Banker.