4th Quarter 2012 Newsletter

Download or print the newsletter:

| RLR Newsletter 4th Quarter 2012 |

If you would like to subscribe to our mailing list, pleasecontact us.

RLR Educational Workshops

RLR Management Consulting has been conducting a series of half day workshops for our clients and other interested financial institutions since 2011. The workshops have been a tremendous success and have focused on industry-related topics including IT Audits and Information Security, the RFP Process and Vendor Selection, Vendor Management, and Operational Risk Management. Additionally, there have been peer exchange sessions at the end of each workshop among the RLR consultants and the bankers in attendance on industry hot topics.

We look forward to our next workshop on February 13th in Los Angeles which will focus on the new FFIEC Guidance, effective 1/1/2013, and Regulatory Compliance Issues affecting the banking community. We are also pleased to feature a guest speaker. Gayle Rose is Cheif Executive Officer of Electronic Vaulting Servives (EVS) in Memphis, TN. EVS specializes in Cloud backup, data storage, and disaster recovery. Prior to joining EVS, Ms. Rose served as Managing Director of Heritage Capital Advisors, LLC., a private equity corporate advisory and asset firm with offices in Atlanta and Memphis. Ms. Rose served as President and CEO of the Chopra Companies from 1996-1999 where she directed the strategic vision and overall business development of the multi-media empire of Dr. Deepak Chopra, famed author and physician. She is also the Chairman of the Rose Family Foundation private charity.

Remember, there is no cost for you to attend…it is our way of saying “thank you” to our clients!

Workshop details:

Date: Wednesday, February 13, 2013

Registration: 9:00am-10:00am

Workshop: 10:00am-2:00pm (lunch will be provided)

Location: Westin Los Angeles Airport

Seating will be limited so we request your RSVP as soon as possible.

Click hereto register via our website.

A Glance Back at 2012

51 Banks failed in 2012, compared to 92 in 2011 abd 154 in 2010. M&A activity appears to be picking up, with 171 mergers and acquisitions in 2012 compared to 160 in 2011. Where will this all lead? With the economy and government behaving as they are, who knows? No further comment!!!

A Look Ahead…

What will 2013 bring? Does anyone know? There are a few “predictions” out there, but not so many with the uncertainty that there is with the economy that definitely impacts the business of banking. We believe that 2013 will be a year of opportunity for the community banks. We think we have seen the “worst” of it and are hoping to see further consolidation and maybe even a small improvement to the market value of banks. On the technology front, Banks need to continue to be mindful of Bring Your Own Device (BYOD), Mobile Banking emerging technology and the risks associated with it, and watchful for more FFIEC guidance.

Ruth L. Razook

CEO and Founder

RLR Management Consulting, Inc.

FDIC Supervisory Insights-Winter 2012-Mobile Payments-An Evolving Landscape

We are constantly asked what laws and/or regulations govern Mobile Banking? Well, to date, no federal laws or regulations specifically govern mobile payments. However, to the extent a mobile payment uses an existing payment method, such as ACH or EFT, the laws and regulations that apply to that method also apply to the mobile payment. In the FDIC Supervisory Insights (Winter 2012), the FDIC provides a good list of laws and regulations taht apply to Mobile Payments Transactions. Read On!

| Law or Regulation/Description | Applicability to Mobile Payments |

|---|---|

| Electronic Fund Transfer Act (EFTA)/Reg E |

Applies when the underlying payment is made from a consumer’s account via an EFT.

|

| Truth in Lending Act (TILA)/Reg Z |

Applies when the underlying source of payment is a credit card (or other credit account covered by TILA and Reg Z).

|

| Truth-in Billing |

Applies when mobile payment results in charges to mobile phone bill.

|

|

Unfair, Deceptive, or Abusive Acts or Practices (UDAP) under the Federal Trade Commission (FTC) Act/Unfair, Deceptive or Abusive Acts or Practices (UDAP) under the Consumer Financial Protection Act6 of 2010

|

Applies to all mobile payments regardless of underlying payment source.

|

| Gramm-Leach-Bliley Act (GLBA) Privacy and Data Security Provisions |

Applies when a financial institution handles information of a “consumer” or “customer”.

|

| Federal Deposit Insurance or NCUA Share Insurance |

If the funds underlying a mobile payment are deposited in an account covered by deposit insurance or share insurance, the owner of the funds will receive deposit or share insurance coverage for those funds up to the applicable limit.

|

Note: This table is not exhaustive, and other laws, regulations, and policies may apply.

Knee Replacement Surgery Checklist

It is truly unbelievable the number of joint replacement surgeries that are done each year. Some estimates say there are approximately 600,000 knee replacements done each year, and it is on the rise! Well, if it works, why not? I never thought at my young age of 56 I would have had a knee replacement, but I did and will have the other one done later this year. We were fortunate to have associated ourselves with Eisenhower Medical Center in Rancho Mirage, CA. I must say, I do believe my Doctor is one of the best. Eisenhower offers a complete “program” to address the before, during, and after sugery on goings. They provide a booklet of how to prepare, what to expect during the surgery, and after care. I would be happy to share the details with any of you preparing for a knee replacement.

Some items that I learned that I wanted to share are:

- Designate an area in your home where you will spend most of the time recouping. The chair/sofa seat should be firm and at the proper height, and easy to get in and out of (trust me, this is important). An ottoman will be needed to help elevate your leg. My favorite friend was my seat cushion. I ordered one from allegromedical.com (#555966). Best $30 bucks I ever spent!

- Everything should be within easy reach, including the phone, TV remote, pain pills (a must!), water, pad of paper, pen, Kleenex, etc. For the first few weeks I used a walker and kept a bag of my goodies on it at all times, which mafe it much less frsutrating when I did not want to get up to answer the phone or grab the remote.

- Place a non-skid surface in the bathtub or shower and a bath mat outside your shower. You will be glad you did!

- I learned that after a joint replacement, each time you visit the dentist you need to pre-medicate, so make sure you tell your dentist and are prepared.

And lastly, to dispel all myths, yes, they come and get you out of bed about 3 hours after the surgery! Ouch! But, I do think they know what they are doing. Good luck to any and all taking the plunge!

Ruth L. Razook

CEO and Founder

RLR Management Consulting, Inc.

Don’t miss this upcoming Webinar offered by WIB:

January 29: Vendor Performance Evaluations & Change Management

Presented by Ruth L.Razook, CEO, RLR Management Consulting, Inc.

START TIME: 10:00 am Pacific(60 minutes)

You’ve got a Vendor Management Program in place, and you know you need to evaluate those vendors on a schedule basis but what are you evaluating? And are you evaluating the right things at the right time?

The FFIEC guidance gives some idea of what needs to be evaluated, but what additional considerations should be addressed that are not necessarily mandated by the regulators? We’ll address the steps and evaluation criteria for the following stages of vendor management:

- Conducting regular performance evaluations and due diligence on current vendors

- Evaluating new vendors for existing services or new vendors for new services

- Change Management during implementation of new vendors

Session attendees will also receive a sample Vendor Evaluation Checklist at the conclusion of the webinar.

Who should attend?

COO, CIO, IT/Tech, Contract Managers, Risk Officers, Compliance Officer, CEO/President

Do you know about a cool bank innovation? Nominate a bank (maybe yours!) for the WIBInnovative Community Banks of the Year Award.

WIB and their co-sponsor BDO, are honoring the creative and innovative achievements of community banks in three asset-size categories. Banks and their supporters are invited to submit a nomination. There is no fee to nominate and you may nominate as many innovations as you would like.

Asset Categories

Three finalists will be chosen for each of the following asset categories from banks in the West:

- < $150 million;

- > $150 and < $500 million;

- > $500 million

Eligibility and Deadline

This award is open to any Community Bank in Western Independent Banker’sfootprint. Nominations may come from bankers or vendor firm. You may nominate more than one bank. There is no entry fee. Questions? Contact WIB at (415) 352-2323 orinfo@wib.org.Deadline for nomination is January 18, 2013.You may email or fax in your submission form with any documentation you wish to submit in support of your entry.

Potential Areas of Innovation

- New approach to old issues

- Products

- New communications approach

- Technology

- Community service

- Recapitalization

- Efficiency improvements

- Approach to customer service

- Delivery/Branch design

Did You Know?

Did You Know?

FFIEC Guidance Update:

The FFIEC has added a new Appendix D to the June 2004 Outsourcing Technology Services IT Examination Handbook. The purpose of this appendix is to identify the risks associated with the Managed Security Service PRoviders (MSSPs) and offer guidance to assist FI’s in mitigating these risks. The loss of control that comes with the outsourced security function intruduces an element of risk that FI’s need to understand and appropriately manage.

Highlights of the guidance are:

-

A risk assessment must be performed as part of, or in cunjunction with, the due diligence review when an FI is considering outsourcing security services.

-

FI’s should:

- Develop RFI’s and RFP’s in accordance with the FI’s strategic planand tactical approachto security.

- Ensure that the RFI defines FI objectives fors the service needed.

- Consider the MSSP’s staffing, certifications, training, transition process, and incident response methodology.

- Coordinate with the MSSP regarding configuration and staff resources.

-

An FI considering and MSSP engagement must perform adequate due diligence to validate that the vendor is capable of managing sexurity services that are aligned with their risk profile.

-

When an MSSP offers services that use a cloud computing architecture, the same risks that are specific to non-cloud-based security services apply but there are a few additional risk considerations that should be assessed when moving to a cloud computing environment.

For more information on FFIEC guidance updates, subscribe to our Technology Guidance PRogram or contact us atinfo@rlrmgmt.com.

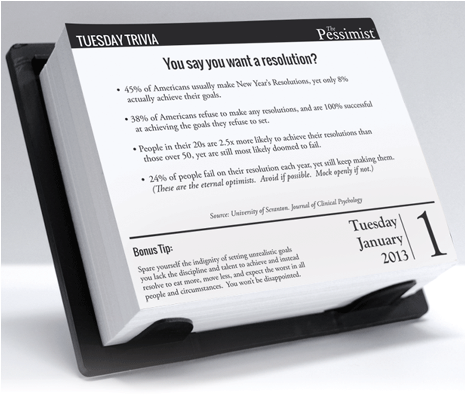

Photo: www.thepessimist.com

![]()

Where RLR will be:

Conferences & Exhibits

- 3/23-3/27WIB-Annual Conference for Bank Presidents, Senior Officers & Directors-Grand Hyatt Kauai, Kauai, HI

- 4/15-4/18Fiserv Forum Spring Client Conference-Venetian, Las Vegas, NV

- 5/2-5/4CBA Annual Convention of Bank Officers & Directors-Hyatt Regency Huntington Beach, Huntington Beach, CA

Corporate Office:

77806 Flora Road, Suite D

Palm Desert, CA 92211

1-888-757-7330 toll-free

(760) 200-4800

(760) 200-4825 fax

Ruth Razook, CEO:ruth.razook@rlrmgmt.com

Mitch Razook, President & COO:mitch.razook@rlrmgmt.com

Tracy Olar, Office Manager:tracy.olar@rlrmgmt.com

![]() Adobe Acrobat PDF file (get Acrobat here)

Adobe Acrobat PDF file (get Acrobat here)